US corporate pension plans manage modest funding recovery in September

Publication date: 2 October 2012 - Mercer

Positive equity returns combined with relatively flat discount rates help improve funded status

However, substantial deficits persist, which will put pressure on plan sponsors financials

Mercer projects a significant increase in balance sheet and expense requirements for many plans for 2013 and beyond

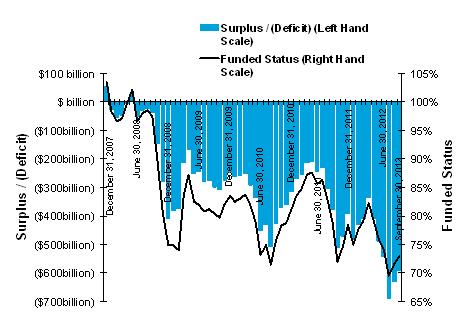

US corporate pension plans managed a modest funding recovery in September. The aggregate deficit in pension plans sponsored by S&P 1500 companies decreased $38 billion during September, to $593 billion, according to new figures from Mercer. This deficit corresponds to an aggregate funded ratio of 73% as of September 30, 2012, compared to a record low funded ratio of 70% as of July 31, 2012, at which point the aggregate deficit was $689 billion.

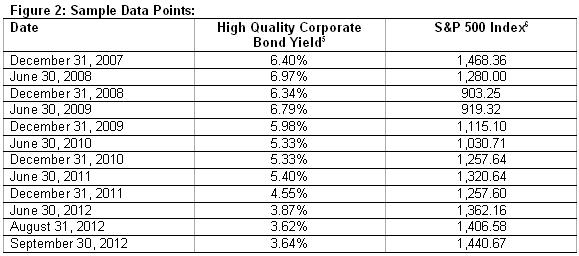

The combination of US and international equity markets rising approximately 3% during Septemberand discount ratesremaining relatively flat helped spur the rebound. Rates had been at a record low at the end of July. But Mercer projects a significant increase in year-end balance sheet adjustments and P&L expense for many plans for 2013 and beyond.

gWhile it is good to see some improvement over the past few months, the funded status of most US pension plans has declined over the past year.h said Jonathan Barry, a partner with Mercerfs Retirement Risk and Finance business. gFrom last September 30, which is a fiscal year end date for some plan sponsors, to this September 30, the deficit has increased $81 billion from $512 billion to $593 billion underfunded, despite significant contributions being made to these plans over the past 12 months.? Since December 31, 2011, the deficit has increased by $109 billion. Plan sponsors need to brace themselves for the balance sheet and P&L implications of these funded status declines as they budget for fiscal 2013. Time is running out for major positive market moves to significantly reduce pension deficits for this calendar year.h

gAlso, now that we have final guidance from the IRS on MAP-21 funding relief, we are beginning to get a sense of cash requirements for 2012.h Said Mr. Barry, gWhile most sponsors have an opportunity to lower near-term contribution requirements, companies should be sure to consider the true deficit they are now facing, and may want to contribute more than these new requirements to help address this shortfall.h

Mercer estimates the aggregate combined funded status position of plans operated by S&P 1500 companies on a monthly basis. Figure 1 shows the estimated aggregate surplus/(deficit) position and the funded status of all plans operated by companies in the S&P 1500. This is based on projections of their reported financial statementsadjusted from each companyfs financial year-end to September 30 in line with financial indices. This includes US domestic qualified and non-qualified plans and all non-domestic plans. The estimated aggregate value of pension plan assets of the S&P 1500 companies at December 31, 2011, was $1.45 trillion, compared with estimated aggregate liabilities of $1.93 trillion. Allowing for changes in financial markets through the end of September 2012, changes to the S&P 1500 constituents and newly released financial disclosures, the estimated aggregate assets were $1.60 trillion, compared with the estimated aggregate liabilities of $2.19 trillion as of September 30, 2012.

Notes for editors

Unless otherwise stated, the calculations are based on the Financial Accounting Standard (FAS) funding position and include analysis of the S&P 1500 companies.

Figure 1